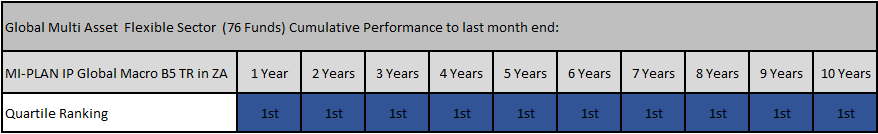

The Mi-Plan IP Global Macro Fund recently reached its 10th Anniversary.

What better way to celebrate with our investors than to announce that the fund is in the 1st quartile over every single period, since inception.

It has also performed better than its competitors in its sector over the whole 10-year period.

Source FE Analytics 1 June 2023

The fund has been managed by Tony Bell throughout this period and has been rewarded with many Raging Bull awards, commencing in 2016. At MiPlan, we seek to appoint best in class asset managers for each of our funds, striving to match the manager’s unique skill to a fund mandate that is suited to their skill. The above achievement is therefore very satisfying for MiPlan and all our clients – and our thanks and appreciation go to Tony for consistently managing this fund with flair.

Clients who were invested in this fund since inception 10 years ago have been rewarded with a cumulative return of 324% since inception compared to the Global Multi Asset Flexible Sector’s average return of 164%. This translates in a return of 15.5% pa, comfortably beating inflation as well as its peers.

And if this feels like déjà vu for your MiPlan investments, you are correct, as it follows on from a similar milestone achieved by the MiPlan IP Enhanced Income fund in 2022.

“Collective Investment Schemes are generally medium to long term investments. The value of participatory interests or the investment may go down as well as up. Past performance is not necessarily a guide to future performance. The Manager does not provide any guarantee either with respect to the capital or the return of a portfolio.”