If you are a financial adviser and are interested in using our model portfolio solutions please email analytics@miplan.co.za to arrange a meeting. For more information download a Client brochure here. Existing investors can find fact sheets, process documentation and quarterly updates by registering and logging into the Mi-Gateway portal.

With the political and economic uncertainty underlying South African financial markets, clients are beginning to request offshore investment solutions. But, with hundreds of offshore asset managers and unit trusts in existence, how to do advisers choose among them? Furthermore, how do you combine offshore funds synergistically and how do you ensure that they meet specific investment objectives? This can be a major challenge. In addition to the size of the investment universe, the information and skills available to an adviser to make such decisions is often limited, making it difficult to construct an effective solution.

Benefits for advisers

A model portfolio addresses the adviser’s challenges by providing a complete solution through a single investment product. MiPlan’s model portfolios are designed to simplify an adviser’s work as they are scalable and cost-effective investment strategies which individually, or in combination, can be used for any type of client. This simplification is particularly necessary for advisers who have a big client base which makes managing their clients’ investments on an individual basis almost impossible. Model portfolios are also key if an adviser is wanting to scale their business and client base. On a day-to-day basis, an adviser will no longer have to worry about the following:

- Portfolio creation

- Administration and compliance

- Risk management

- Investment process

- Due diligence

- Portfolio monitoring

The basic principle of a model portfolio is the grouping of more than one unit trust to form a portfolio, the premise being that a single unit trust fund seldom ranks consistently as the top performing fund. Different managers have different areas of expertise, be it asset allocation, stock selection, investment style, etc. A well-structured model portfolio solution will focus not only on the identification of superior funds but also on blending them together in a way that takes advantage of complementary manager skills. With the right mix of funds, synergy can be achieved.

Benefits for clients

A model portfolio provides access to the skills of some of the best investment managers, blends funds synergistically, and improves the client’s chance of achieving their investment goals. By opting for a model portfolio solution, the client may be afforded the following benefits:

- Diversification of manager risk

- Cost effective

- Comprehensive due diligence of all managers

- Ongoing portfolio monitoring

- Focus on investment objectives

MiPlan’s investment philosophy is based on selecting the right asset managers, understanding their ‘DNA’, and blending them together to achieve synergy. Important aspects of manager DNA are:

- How have the managers performed in comparison to peers?

- How volatile have they been in comparison to peers?

- How consistently has the manager “got it right”?

- Have the managers successfully protected the downside?

MiPlan currently offers generic offshore model portfolio solutions. There are three solutions for advisers with specific risk profiles and investment objectives – Offshore $ Global Cautious, Offshore $ Global Balanced and Offshore $ Global Equity. These portfolios individually or in combination, allow the investor the greatest likelihood of attaining their financial goals. The product design and investment philosophy are key to the achievement of these goals.

Portfolio creation

Funds are first analysed within their full universe alongside all peers using an internally developed DNA identification system which categorises all funds across various risk and return metric over time. Selecting candidates differs depending on the portfolio – High returns with minimum exposure to risk are ideal but, by design, earning higher returns generally involves taking on more risk. For more conservative portfolios we are more conscious of protecting the downside and so we are willing to sacrifice some returns to improve the risk characteristics of the portfolio. For aggressive portfolios, on the other hand, the focus shifts to higher returns with a greater risk tolerance.

We aim to combine managers with different DNA to create synergy – the 1+1=3 philosophy. The process involves combining some higher risk, higher return managers with some lower risk, lower return managers which serve as the stable core for the portfolio. Portfolios are designed to be low cost, risk controlled, multi-manager solutions consisting of funds managed by leading global asset managers.

Macroeconomic trend analysis is then used to identify investment trends across regions, asset classes, investment styles, themes, & sectors globally. Exposures to these factors are blended through a mix of active and passive funds to reduce risk and costs.

Additional factors which form part of our process are the likelihood of the fund outperforming its peer average, fees, risk management from a bottom-up holdings perspective, and qualitative factors (reputation, confidence in brand, quality and stability of management team, size constraints of the fund, understanding of manager’s position, remaining true to DNA).

Monitoring

Funds & exposures are monitored and reviewed monthly to ensure that they do not deviate from their ‘DNA’ which led to their inclusion in the portfolio. Drift in a manager’s position within the quantitative framework serves as a trigger for further investigation as do changes in momentum across asset classes, regions, themes etc.

If ‘DNA drift’ or momentum changes are detected and deemed significant, we drill deeper to establish the cause of the changes – have there been material changes in DNA or is it simply a temporary market related drift? Have there been material changes in the value of an asset class, attractiveness of a region, etc? If the change has been material then this may warrant removal or substitution of one fund for another.

MiPlan provides advisers with the following documentation:

- Process documentation

- Monthly reports

- Quarterly reports

All documents are made available online via our portal Mi-Gateway.

Investment Committee Meetings

Investment committee meetings are held at least semi-annually during which the adviser will meet with the MiPlan team who will report back on any changes that have been made to the portfolios, discuss market movements and the MiPlan multi-manager research process, as discussed above.

MiPlan’s offshore model portfolios are available on these three major Linked Investment Service Providers (LISPs):

- Glacier

- Ninety One (formerly Investec)

- Momentum

However, efforts will be made to make the portfolios available on other platforms if it is critical for an adviser to have access to the portfolios on another platform.

Offshore $ Global Cautious

Key Facts

| Inception date | 9 January 2017 |

| Objective | Income and Growth |

| Reg. 28 Compliant | No |

| Asset Composition | Equity, Fixed Interest, Property and Cash |

| Benchmark | EAA Fund USD Cautious Allocation average |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

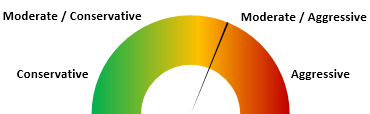

Suitability

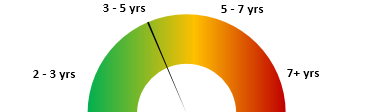

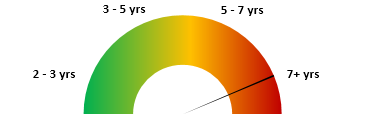

This strategy is suitable for moderate risk investors with an investment time horizon of three to five years.

Objectives

The strategy aims to achieve income and capital growth over a rolling three to five year period while maintaining acceptable levels of risk exposure. The recommended time horizon is at least three years.

Risk Profile

Time Horizon

Offshore $ Global Balanced

Key Facts

| Inception date | 16 December 2016 |

| Objective | Balanced Growth |

| Reg. 28 Compliant | No |

| Asset Composition | Equity, Fixed Interest, Property and Cash |

| Benchmark | EAA Fund USD Moderate Allocation average |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

Suitability

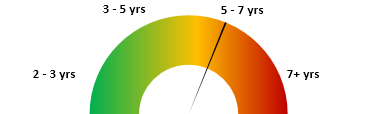

This strategy is suitable for moderately-aggressive investors with an investment time horizon of five to seven years.

Objectives

The strategy aims to achieve income and capital growth over a rolling five to seven year period while maintaining acceptable levels of risk exposure. The recommended time horizon is at least five years.

Risk Profile

Time Horizon

Offshore $ Global Equity

Key Facts

| Inception date | 23 November 2016 |

| Objective | Growth |

| Reg. 28 Compliant | No |

| Asset Composition | Equity |

| Benchmark | EAA Fund Global Large Cap Blend Equity average |

| Income Declaration | Reinvested |

| Fees | 0.2% per annum (excl. VAT) |

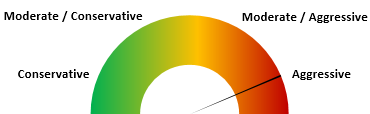

Suitability

This strategy is suitable for aggressive investors with an investment time horizon of more than seven years.

Objectives

The strategy aims to achieve capital growth over a rolling seven to nine year period while maintaining acceptable levels of risk exposure. The recommended time horizon is at least seven years.

Risk Profile

Time Horizon

If you are a financial adviser and are interested in using our model portfolio solutions please email analytics@miplan.co.za to arrange a meeting.